Independent contractors are a great way for businesses to hire specialists for short-term projects. But hiring contractors can mean jumping through a few hoops for payroll and taxation.

In this blog, we’ll take you through the differences between W2 and 1099 employees, guidelines for onboarding 1099 employees, and much more.

Who is a 1099 Employee?

Individuals who are self-employed workers and do not fall under any employment classification rules are known as 1099 employees. The pay to 1099 employees is based on their contract, and the 1099 form is provided to report their income on tax returns.

1099 employees are also considered freelancers, self-employed individuals, and independent contractors. They own their businesses, and they provide a broad range of services to clients. 1099 employees or freelancers establish business relationships with various clients. The clients can range from small businesses to enterprise clients.

The reason why this classification is so important is that 1099 employees get paid for the work that they perform for their clients without any tax deduction.

Clients associated with 1099 employees have a lower degree of control as compared to the 1099 employees who have a lot of autonomy over their way of working. Companies can avoid paying taxes by hiring independent contractors or 1099 workers.

A broad range of workers come under the category of 1099 employees, including even blue collar workers, like plumbers writers, and electricians.

Who is a W2 Employee?

A W2 employee is a regular employee who works directly for the business and is part of the payroll. Traditionally, W2 employees do not own businesses of their own. They are employed by the business for which they get a salary. The employer holds a high degree of control over the business activities and determines the work schedules, benefits, and wages of W2 employees.

The employer is responsible for W2 employees’ benefits, perks, and salaries. The employers consequently possess a large degree of control over the employees and also withhold income taxes from the employee’s paycheck. W2 employees are also eligible for any wellness initiatives by the business and work in accordance with all the business requirements.

All employees are classified as W2 employees unless there is a compelling reason to classify them as independent contractors or 1099 employees.

1099 vs. W-2 Employee

Classification of an employee either as a W2 employee or as a 1099 employee is vital for the business. The misclassification of a W2 employee as a 1099 employee can result in penalties from the Internal Revenue Service (IRS). Classification of an employee is also vital for identifying the extent of control that the business has over the pay and schedules of the employees.

However, independent contractors almost always pose a lower cost to the business. This might make unscrupulous businesses misclassify their employees. However, the IRS can audit the business and identify if it has done any misclassification of its employees. It’s certainly more trouble than it’s worth.

IRS provides guidelines clarifying the correct classification of workers into three categories which are listed below-

The First Category: Behavioral

The behavioral category focuses on identifying whether a business can control what, where, how, and when the worker carries out their job.

The Second Category: Financial

The financial category focuses on determining who controls the economic aspects related to the worker’s job and method of payment.

The Third Category: Types of Relationship

The types of relationship categories are focused on determining whether the employee receives benefits or not. This along with the documentation filed can establish the type of relationship between an employee and the business.

Difference between W2 and 1099 Employees

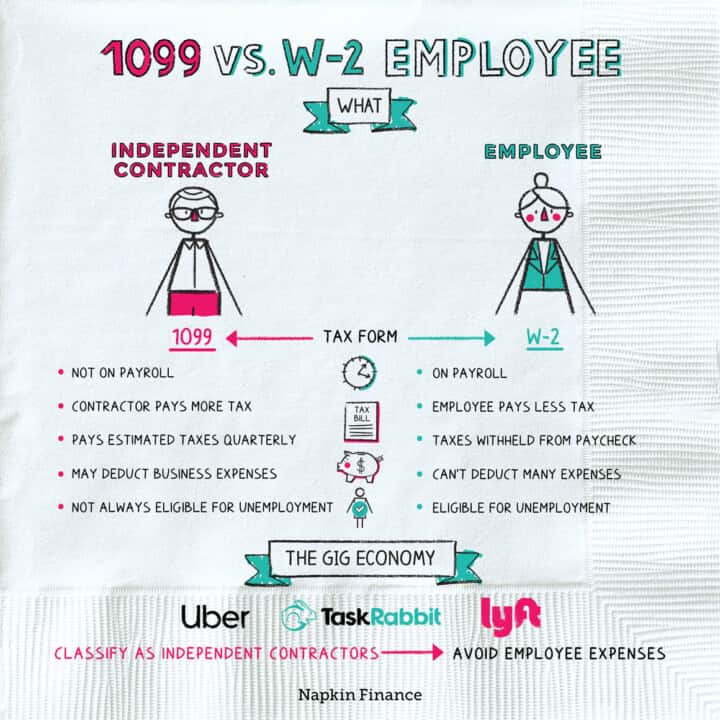

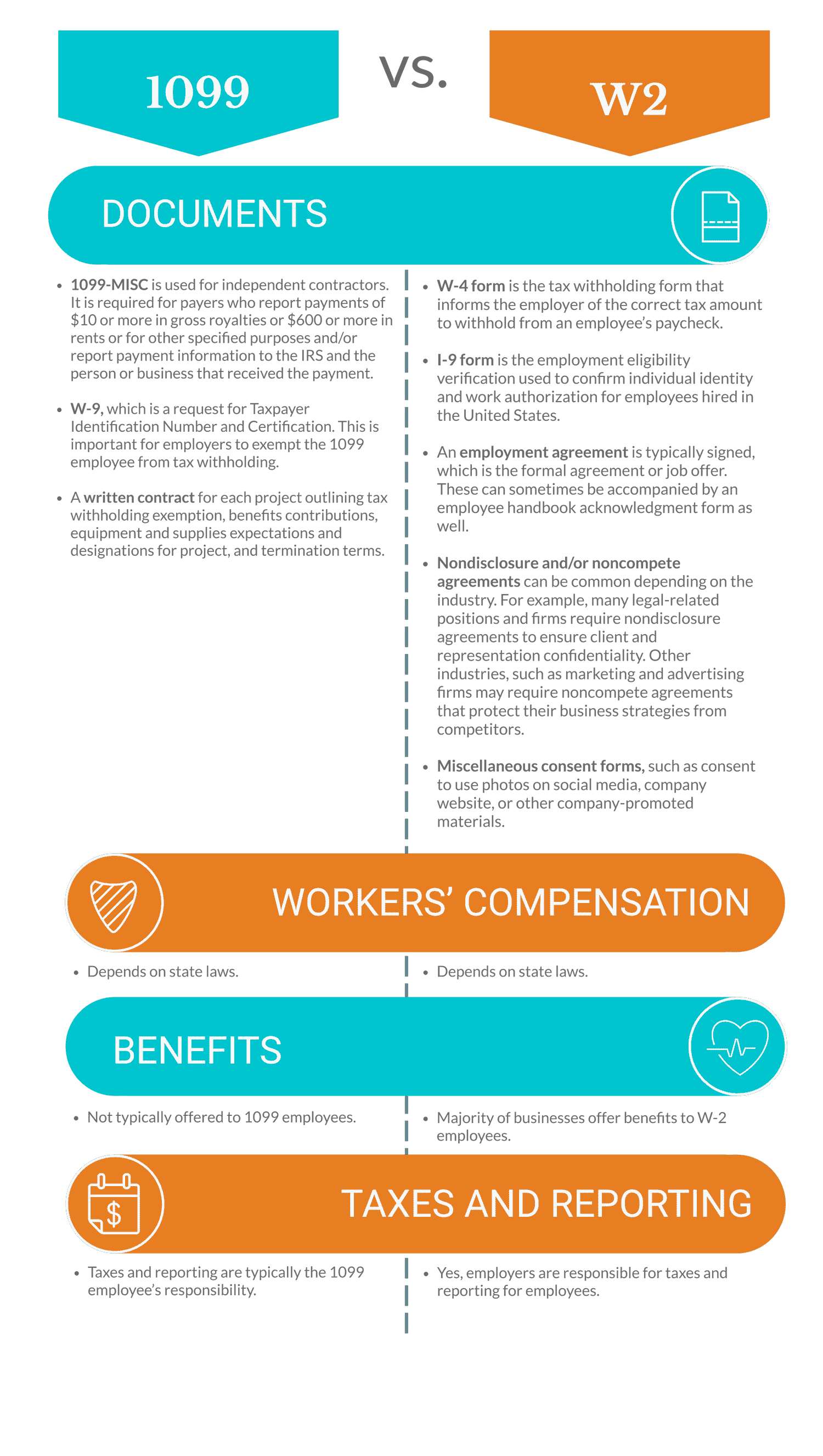

Tax Forms

In terms of tax forms, independent contractors and permanent employees on the company payroll have two different tax forms. Unsurprisingly, a 1099 form is filed for 1099 employees and a W2 is filed for W2 employees for payroll taxes.

A 1099 employee is an independent contractor, and businesses pay them according to their contracts. On the contrary, a W2 employee is a salaried employee who receives wages and employee benefits regularly. The business not only holds a large degree of control over the W2 employee’s work but also withholds income taxes from the employee’s paycheck.

Schedule

A 1099 employee is hired by a business for a specific project or task. 1099 employees provide the business flexibility in terms of hiring and “firing”. Their hours spent with the business are dependant on the project requirements and their own schedules.

On the contrary, W2 employees are controlled by their employers as the employer determines the schedule and remuneration for W2 employees.

Employment Type

A 1099 employee is self-employed, while W2 employees are salaried employees. Unlike 1099 employees, W2 employees do not own a business. Rather, they work for a business and work towards achieving the business’s goals.

A 1099 employee provides only services that are defined in the written contract. It is entirely up to them if they wish to cater to just a single client or many at the same time. There is no non-compete clause associated with their services rendered. But W2 employees can only work full time with one business at a time.

Training

1099 employees do not need to be trained by the organizations as are experts and are hired for their expertise. On the contrary, W2 employees need to be trained to adhere to processes and to improve their skillset.

1099 employees mostly perform tasks without the employer’s processes. Their goals are oriented to end-results and process creation. However W2 employees have to follow the businesses’ processes while performing all tasks.

Expenses

Independent contractors or 1099 employees are responsible for their own employment expenses and taxes. While in the case of W2 employees, the business withholds payroll taxes from their salaries to cover the employment expenses.

A 1099 employee is not eligible for unemployment benefits, but the W2 employee is eligible for unemployment benefits in special cases.

Benefits of a 1099 Employee

Expertise in Specific Field

Perhaps the most significant advantage of working with a 1099 employee is the expertise possessed by the 1099 employee in a specific field. In case a venture requires particular expertise or specialized ability, the business can hire a 1099 employee who has constructed a business around that very specialization. 1099 employees possess specialized skills and expertise that are more streamlined or missing in the capabilities of the organization’s core team.

1099 employees are well versed in their domain and bring additional experience to the organization.

Flexibility

Businesses and organizations can hire a 1099 employee for as many projects as the budget allows. Contrary to a W2 or a regular employee who is associated with the business for a long period, 1099 employees provide flexibility to the businesses in terms of prioritizing and shifting resources.

Organizations hire 1099 employees for accomplishing a specific project as they can focus on a particular project without increasing the employee headcount.

Easy Administration

Administration becomes significantly easy for the organization by employing an independent contractor. The initial paperwork is quite less, and payroll is easier as the employers do not hold any responsibility when it comes to withholding payroll tax. However, an organization needs to make sure that the classification of employees is correct each time.

Cost-Effective

Cost-effectiveness is a vital factor for businesses, and it can be achieved by utilizing a 1099 employee in place of a W2 employee. There is no need to provide minimum wage and benefits to 1099 workers or independent contractors.

Moreover, the paperwork is quite less for an independent contractor or 1099 employee as compared to a W2 employee.

Less Legal Exposure

1099 workers are not eligible for any kind of compensation coverage. Additionally, they cannot make wrongful termination claims, which in turn lowers the legal exposure of the business.

How to Hire a 1099 Employee

Hiring reliable 1099 workers or freelancers can be beneficial for organizations. They can provide certain benefits, including cost-effectiveness, flexibility, less paperwork, and extensive expertise in a particular domain. Companies need to be careful while hiring independent contractors to benefit from the onboarding of independent contractors.

After signing the employment contract that should ideally include expectations, termination terms, duration of the project and equipment provided, the next steps are:

Ensure a 1099 Employee is Classified Correctly

Make sure that a 1099 employee is:

- Not working full time for the business

- Does not require any special training and supervision

- Offered any benefits

- Clear about their employment status with the company

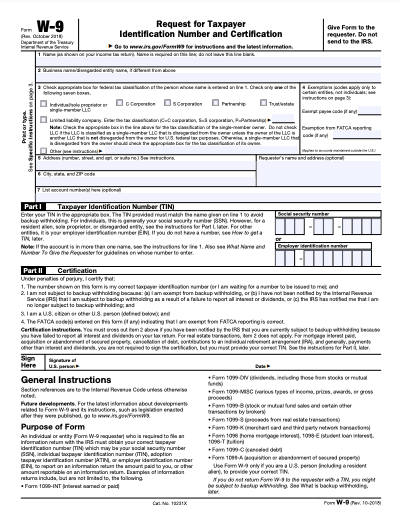

W-9 Form

A W-9 form is a must for all independent contractors. A W9 provides their:

- Name

- Current Address

- Tax Identification Number

- Eligibility to work in the United States

It doesn’t need to be sent in anywhere but every business must have the W9s of all 1099 employees on file. Getting all details, in the beginning, will save you many headaches later.

Confidentiality Agreement

A non-disclosure agreement (NDA) is integral for independent contractors. This confidentiality agreement should outline that any confidential material, information, and knowledge cannot be shared with a third party.

Not all businesses require an NDA but to cover all bases it is prudent to get one signed during onboarding of the contractor.

The Correct 1099 Employee Form

A 1099 employee form is a document or a combination of documents that are used by the IRS for tracking various types of income, excluding the salary that an employer receives. The person who pays is responsible for providing a 1099 employee form to the independent contractor. There are various kinds of 1099 employee forms, including the 1099-MISC form and 1099-INT form.

1099-MISC

1099-MISC is a document for people who engage an independent contractor or freelancer and pay them an amount above $600 annually. Employers need to submit the 1099-MISC form for individual independent contractors who receive an income over $600.

1099-INT

The 1099-INT form is a document that is received from banks where the independent contractor holds interest-bearing accounts. The interest that is earned on investments is taxable, and in this aspect, it is reported to the IRS.

1099-NEC form

A 1099-NEC form reports non-employee compensation. The 1099-NEC form is not a replacement for the 1099-MISC form but rather replaces its usage for reporting independent contractor payments. The 1099-NEC reports how much an independent contractor earned while working with the client. This does not include payments made via credit cards or third-party settlement platforms.

The independent contractor, as well as the employer, needs the 1099-NEC form for filling out the taxes. The 1099-NEC form has two copies, Copy A is filed with the IRS, and Copy B is sent to the individual contractor by the employer. The 1099-NEC form is not part of the State Filing Program, which is why an employer might need to submit 1099-NEC to the state where the independent contractor works. 1099 employee taxes can be determined by filling and submitting the form.

1099 Form Deadlines

January 31

1099 forms must be sent to all your 1099 employees by the end of January. If this day falls on a weekend, the deadline is extended till Monday.

February 28

1099 forms issued must be filled and sent to the IRS by the end of January. Not filing these forms accurately and on time can open the business to penalties.

1099 Employee Rights

Taxes Paid

The 1099 employees do not pay social security and unemployment taxes. Instead, they pay taxes on the gross pay received from organizations. Subsequently, businesses can be on the hook for backdated taxes if they fail to classify independent contractors correctly.

Tax Administration

If the IRS identifies that a salaried employee has been represented as an independent contractor there will be repercussions. The business can be held accountable for backdated withholdings to the tax administration.

Work in Several Companies

1099 employees do not possess an exclusive employment relationship with any organization. However, this makes them ineligible for benefits like minimum wages, overtime payment, and other perks.

However, the business cannot prevent 1099 employees from working with several companies simultaneously either.

Freedom

Independent contractors possess the freedom to work from their place and at their convenience.

However, a situation may arise where the client expects the 1099 employees on-site during a specific project. In that case, the employer is responsible for providing the necessary tools and equipment to the independent contractor.

Termination

The business can end the agreement of the 1099 employee at will in case explicit termination conditions are not included in the contract. It is the right of the individual contractor to discuss the termination procedure before agreeing to work on a project and incorporate it into the contract.

Is Hiring a 1099 Employee Beneficial for a Business?

A 1099 employee can bring benefits such as cost-effectiveness and flexibility. However, the business needs to determine and define the requirements of an independent contractor.

Are you finding it hard to track hours for your 1099 employees? We think AttendanceBot, a time tracking solution that functions right within MS Teams and Slack, can help.