Medical costs in the United States are some of the highest across the world. Since Americans are still not offered universal health coverage, they need to be meticulous about health insurance coverage.

Regardless of employment status, Americans are constantly on the lookout for health insurance that best suits their healthcare needs. But when an individual’s employment status changes this issue can be all the more pressing. If their health insurance coverage is in flux, they could be one hospital stay away from bankruptcy. That’s how dire the situation is for many Americans.

These life events shouldn’t be when employees learn about alternate forms of health coverage. But quite often, that may be the case.

In this article, we’ll take you through what COBRA health insurance is, what it covers, and how much it will cost.

What is COBRA Health Insurance?

After quitting their jobs, employees may miss out on the benefits of health insurance coverage offered by their employer. In the United States, the federal government provides insurance coverage to employees and their families between jobs. The law that grants this safety net is called COBRA, which stands for Consolidated Omnibus Reconciliation Act.

COBRA coverage applies by default to employees covered under a medical, vision, or dental plan sponsored by employers. It is mandatory for companies that have more than 20 employees in their organization. Employees are allowed to include their spouses and dependents under the COBRA plan.

Those employees who have been fired OR have resigned from their previous jobs must know the following.

When Does COBRA Coverage Start?

Usually, employees must subscribe to COBRA coverage within 60 days of the end of their previous employment. It starts from the day the benefits of their former health insurance plan end. The main advantage of COBRA insurance is it works as health insurance for unemployed people too. If a medical emergency arises during this period, COBRA health insurance will provide coverage to the employees and their families.

Getting COBRA Insurance After Quitting Your Job

COBRA insurance allows employees to retain the health benefits offered by their employer after leaving the job. The employees need to pay the COBRA policy premium till they find a new job or get a separate policy. Further, it also applies to employees facing reduced working hours due to misconduct or other reasons. Therefore, it becomes necessary for employees to know how much the COBRA insurance premium is.

The COBRA policy premium is much higher than general insurance policies. This is because the employer will no longer pay the substantial part of the premium as they did previously. Also, employees cannot choose COBRA coverage in the following cases:

- If the employer is no longer providing a health insurance plan due to suspension of health coverage.

- The organization has been shut down and, therefore, does not offer health coverage to the employees.

How Long Does COBRA Insurance Last?

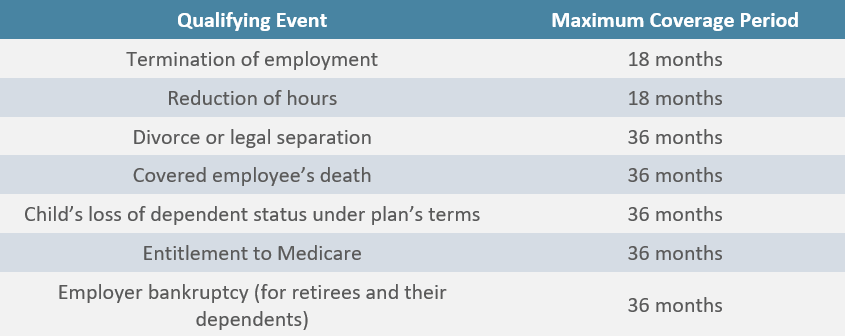

The length of coverage determines whether or not they will be able to claim the benefits of the health insurance plan. Once the previous health insurance plan benefits end, the COBRA plan remains active for 18 months. In some cases, it may last up to 36 months.

State-Wise COBRA Coverage

As COBRA insurance applies to employers across the US, employees are entitled to the benefits and coverage in various locations. However, it is administered differently by every state. Here are some of the primary differences:

- COBRA insurance California offers coverage for 36 months for both employees and their dependents.

- On the other hand, COBRA insurance in Florida provides coverage for only 18 months.

- COBRA insurance Illinois offers coverage for up to nine months for employees covered continuously for the initial three months.

- COBRA insurance New Jersey implements COBRA rules for the organizations that have two to 50 employees.

- However, COBRA insurance in New York only includes those organizations that have fewer than 20 employees.

- Finally, COBRA insurance Texas is implemented for all the employers who provide group health insurance.

Despite these dissimilarities, most states offer ways to enable employees to continue their health insurance coverage. Most of the states require employees to be covered for a certain period before quitting. Three months is the coverage period that is accepted by most states.

Also, for continuing COBRA coverage, the employees need to pay out of pocket. They have the option to convert their group insurance policies to an individual health plan after quitting their jobs.

Rules Associated with COBRA Insurance

Before getting COBRA coverage, every employee must learn more about the rules. The employees will need to subscribe to a new health insurance plan before the COBRA coverage retroactive period ends. There might be instances when an individual is unable to find a new job even after 18 months. In such cases, the employee can choose any one of the following options.

Joining Their Partner’s Health Insurance Plan

Employees can join their partner’s or spouse’s health insurance plan if they leave their current jobs. Joining their partner’s health insurance coverage is also possible if they are not covered under any group insurance plan.

For this, both partners must enroll in the health insurance plan offered by the spouse’s employer. Also, they should do it within 30 days after one of them leaves their job.

Subscribing to a New Health Insurance Plan

Employees need not wait to enroll in their partner’s health insurance plan if they leave their current job. They also need not qualify for any other life event that requires medical coverage. Instead, they can subscribe to a new health insurance plan by comparing the best available insurance plans in the marketplace. The benefits of the new insurance plan will apply from the first day of the month that follows, once the employee has left the job.

Eligibility for CHIP

The employees who belong to moderate or low-income families might qualify for CHIP (Children’s Health Insurance Program). CHIP is co-sponsored by the federal government and states. They can find more details about this healthcare program through the official healthcare website of the federal government.

Cost of COBRA Coverage

Generally, employees pay around 20% for an individual policy premium and 30% for a family policy premium. The employer pays the remaining amount. However, the employees need to pay 100% of their COBRA premium costs, as well as a 2 percent additional charge for administrative costs. Therefore, the amount payable to maintain the insurance benefits is higher than the standard wage deduction during their regular employment.

Still, this amount will be lower than the premium of a separate health insurance plan obtained from the open market. Also, the employees will be entitled to the group discount that they were getting from their previous employer’s insurance plan.

Employees can pay the COBRA coverage premium from their Health Savings Account (HSA). Also, they can subscribe to a much cheaper health insurance plan during the subsequent open enrollment period.

The difference between COBRA policy premium and standard wage deduction made against an employer’s health plan is given below:

| Health Insurance Plan Type | Estimated Deduction From Monthly Salary (in USD) | Estimated Monthly Premium for COBRA (in USD) |

| Individual health insurance plan | 101 | 558 |

| Family health insurance plan | 476 | 1,564 |

| Family HDHP (High-deductible Health Plans) | 383 | 1,465 |

| Individual HDHP | 85 | 417 |

How Does COBRA Insurance Work?

One must remember that COBRA insurance is a temporary health coverage plan. It enables employees to continue receiving the benefits of a health care plan after leaving their jobs. Therefore, it is essential to understand how COBRA insurance works before getting it.

The employees have a period of 60 days to decide whether they need COBRA coverage. On failing to choose COBRA insurance within this period, the insurance benefits end once the employer’s health coverage ends.

Employees who choose COBRA coverage will get coverage from the day the employer’s insurance provision ends. The benefits will be similar to those offered by the employer’s group insurance policy. Therefore, the employees can get treatment from the same clinics or choose doctors they had previously consulted.

COBRA coverage will end on the day the employees get a job that provides health insurance. It may also end abruptly if the employees do not pay the policy premium within the stipulated time.

COBRA medical insurance does not provide additional benefits or coverage other than those available in the group insurance plan offered by their previous employer. If the employees had taken a separate health insurance cover, life insurance policy, or disability insurance, the benefits would not be covered under COBRA.

The employees can get clarity about their eligibility for COBRA health insurance from their employer’s Human Resource Departments. They can also seek information regarding COBRA coverage from the insurance provider.

The insurer must include information on COBRA rights in their policy documents for the employees’ reference while purchasing health insurance.

What are COBRA Qualifying Events?

COBRA qualifying events are the instances or conditions during which COBRA insurance can come into play. Here are the main COBRA qualifying events that every employee working in the United States must know:

- The primary condition is that the employees should have been covered under the group insurance plan of their previous employer. Also, they must have resigned, been fired or laid off, or faced reduced work hours to be eligible for coverage.

- If an employee dies, their spouse may be eligible for COBRA medical insurance. The spouse of the employee who has filed for a divorce or legal separation also qualifies for COBRA.

- Dependents of the employees eligible for COBRA qualify for the medical coverage extended by this law.

Is an Individual Health Plan or COBRA Health Insurance Better?

The suitability of a health insurance plan for an employee depends on their health requirements.

- COBRA insurance is preferred over individual health insurance because it allows employees to continue receiving the coverage without a break.

- An individual may opt for an additional health insurance plan after quitting the job. In this case, they may get the same health coverage at a much lesser price than COBRA insurance. The new insurance plan usually comes with a waiting period and might not offer the immediate relief as COBRA benefits.

Employees might get maximum coverage with a minimum waiting period through a separate health insurance coverage plan. For this, they must explore the applicable individual health care plans even when the enrollment time is not open.

FAQs About COBRA Coverage

Some employees may leave their job or have their working hours reduced. They must pay their first premium within 45 working days of choosing COBRA insurance through the election form. If the premium is paid is made on time and in full, the COBRA retroactive period will be covered consistently. If the employees fail to pay the policy premium, the employer might not provide COBRA continuation coverage.

In such cases, they may restrict the benefits only to Medicare. The employer might also stop the coverage if the employees are insured via another plan or exhibit suspicious conduct.

What happens if an employee has subscribed to both Medicare and COBRA coverage?

The Medicare plan will cover the expenses during an emergency first if employees have both Medicare and COBRA insurance coverage. The expenditure outside the scope of the medicare plan will be taken care of by COBRA health insurance.

Is an employee entitled to receive the benefits of COBRA insurance even after the company closes down or terminates their health insurance plan?

If the company closes down or terminates its health insurance plan, the COBRA plan benefits will not remain applicable. In such cases, the employees will have to look for other health coverage alternatives.

Are employees entitled to the benefits of the COBRA health insurance plan if the employer furloughs them?

Furlough is a situation in which an employer lays off or grants temporary leave to their employees. During the furlough period, the employer decides whether to continue the coverage of the group insurance policy. If the coverage and benefits are discontinued, the employees can take advantage of COBRA insurance. Sometimes, the employer may provide health coverage and benefits, even for the furloughed employees. Therefore, the employees do not need COBRA coverage to manage their healthcare requirements.