Multiple laws such as ERISA are set into motion to safeguard the private sector workforce, with post-retirement protection as the primary concern. The ERISA law refers to the Employee Retirement Income Security Act.

This gives the minimum threshold or norms to retire relevant to the private sector employees. The federal government introduced this law back in 1974, and it outlines the standards of retirement and health.

Let us help you understand what ERISA is, and what the right retirement plans are for your employees.

What does ERISA stand for?

The Employee Retirement Income Security Act – ERISA – was enforced by the Federal Government as a law in 1974. The U.S. Department of Labor website features the prerequisites as the base requirements for most voluntarily established retirement, health plans, life insurance, disability insurance, apprenticeship plans, etc.

What is ERISA?

ERISA aims to safeguard the interest and the future of employees and their beneficiaries who opt for retirement and insurance plans via their employers.

Inclusions of the law are minimum standards for participation, vesting, benefit accrual, and funding. The Act states the essential threshold for availing the plan, i.e., employment duration deemed eligible for availing the plan. Post availing of the plan, employees will be entitled to the plan. Funding details for the sponsors are well-drafted in the law.

Regulatory Authorities of ERISA

Further insights into the authorities responsible for efficient enforcement are the Department of Labor, IRS, and PBGC.

The Department of Labor has the obligation of incorporating rules and duties implied on the fiduciaries or the plan managers. The IRS looks out for the participation fund and vesting rules modeling, i.e., creation and management. On the other front, PBGC is the insurer of private pension funds.

The act does not direct every employer from the private sector to offer plans but states the guidelines for those who render.

What is the Main Purpose of ERISA?

The primary motive is – protection of retirement savings.

The law protects the beneficiaries from mismanagement or misuse. Plan managers should feel responsible and act in the favor and interest of the participants. The law states that everything should be transparent, and minute details should be revealed to the participant. The law directs the protection of the plan and order and ensures that beneficiaries receive the entire set of benefits.

This Youtube video best sums up the ERISA plan’s norms and briefs on the purpose of ERISA. Also, here are the constituents of the Act.

Which Employees are Entitled to Protection under the Act?

ERISA act maps out the requirements of retirement plans and welfare benefit plans. Stats that indicate the progress of the act are 684,000 covered retirement plans, 2.4 million health plans, and 2.4 million additional welfare benefit plans as of 2013. Beneficiaries and workers accounted for 141 million in the same year, while the assets accounted for up to $7.6 trillion. The beneficiary is entitled to the benefits of the plan.

- ERISA income security covers employees of private sector companies, such as partnerships, proprietorships, LLCs, S-corporations, and C-corporations.

- Exceptions to the ERISA security retirement are government employees, churches, synagogues, mosques, temples, exclusive workers’ compensation, disability or unemployment laws plans, unfunded excess benefit plans, and non-resident plans.

Participants then add an ERISA beneficiary, who would receive the benefits of the plan. In the event of a participant’s death or a qualified domestic relations order (QDRO), beneficiaries can claim the benefits.

What is Covered under ERISA?

ERISA authorities mention the hub of protections eligible employees would receive under the health and retirement plans.

- Firstly, employers must provide employee details, including funding and features of the plan. The law states that employers should disclose the spouse participation norms in case of unfortunate events like death.

- Secondly, the management that controls the assets of the plan should be the fiduciaries for participants. They must weigh in the interests of the participants over the organization or self. They would also be liable for losses of the plan in case they act contrary to their responsibilities.

- Lastly, the participants have the right to claim the benefits at the right time. It also gives the participants the right to sue in case of a breach of rights. Also, the law would protect your benefits if the plan is terminated under any circumstance.

Rules for ERISA

ERISA monitors what rules employers can set for participation in benefit plans and defined contribution plans (ERISA 401k). The law gives companies the flexibility to decide the participant’s eligibility criteria and has also set a limit.

Companies are free to include norms of participation, such as minimum age of 21 and a certain period of service. But the law states the companies have no right to discriminate based on other age-related factors. For example, an older employee cannot be barred from the plan since they are near retirement.

The law also briefs on the benefits the participants receive on retirement. In particular, for defined benefit plans, companies can change accrued future amounts but cannot change the benefits already earned. The benefits you already received are yours, and you have a right to them, but the future entitlements can vary.

Second, strict laws govern the withdrawal of ERISA funds. You have the sole right to all the money you deposit in your account, but not the right to withdraw it anytime. It basically depends on your employers and the terms they set.

Vesting represents ownership of funds, and there are two options of vesting provided to employers.

- Cliff – Employers can choose to go for a five-year cliff or opt for a graduated vesting schedule in a defined benefit plan. In the five-year cliff, employees own the entire amount and are considered fully vested.

- Graduated – In the graduated vesting schedule, employees are 20% vested at three years of service. Furthermore, employees are 40% vested in 4 years, 60% in 5 years, 80% in 6 years, and 100% thereafter.

Standard ERISA Rules

Standards stated in the law, inclusive of ERISA fiduciary, are:

- Plan managers must provide all facts of health and retirement plans.

- Create trust accounts to hold any plan assets.

- Contributions made to the plan should be deposited on time.

- Recordkeeping guidelines.

- Document filing guidelines.

- Fiduciary responsibilities.

- Minimum funding requirements.

- Uniform vesting schedules.

- Appeals and grievance processes.

- Employees must be notified of the changes in plans.

- The right to sue for breach of fiduciary responsibility.

ERISA Plan Layout

The standard process employers must follow includes providing detailed information of the plan in writing. It would also include the factors that would deem an employer an eligible participant. The employer must also disclose the details of the insurer in the case of health, dental, and vision coverage plans.

A summary plan description, or SPD, is one of the crucial ERISA requirements. Employers, who carry out the process of funding themselves, draw their own information. Employers must also provide a draft of the summary plan that clearly outlines the employee rights. Other essentials of the draft are – eligibility stats, costs associated, benefits provided, etc. The process can as well include a third party that helps employers with the documents process.

ERISA Qualified and Non-Qualified Plan

- Qualified Plans – Qualified plans are those where employee contributions are pre-taxed or contrarily tax-deductible under IRS rules. Non-discriminatory rules must also be a part of the plan, where every other employee can enjoy the benefits.

- Non-Qualified Plans – ERISA does not include tax-deferred compensation and bonus plans specially meant for the executive level staff. Here, contributions from employers or employees are taxed.

Plans Excluded from ERISA

Primary exceptions to the act are payroll practices and voluntary plans. Other plans not included in ERISA coverage are:

- Adoption plans.

- Section 125 premium-only plans.

- Commuting benefits.

- Dependent care assistance programs.

- Health savings accounts.

- Pet insurance.

- Financial/retirement planning programs.

- Health fitness or exercise club membership.

- Liability or casualty insurance plans.

- Professional development classes (unfunded).

- Scholarship programs (unfunded).

- Sporting event tickets or discounts.

- Tuition reimbursement.

- Unemployment compensation is provided solely to comply with state law.

- Workers’ compensation benefits are provided solely to comply with state law.

Rights of Retirement Plans Beneficiary and ERISA Account Holder

HR educates the participants regarding ERISA and ERISA regulations. Participants of the plans have the authority to sue the plan manager for benefits and entitlements. Participants can also report any breach in the fiduciary duty.

Other aspects include the obligations that employers have towards the employees. Employers must disclose all the information of the plan, such as the features and model of the plan. The second employer’s obligation is to comply with the prescribed fiduciary duties. Lastly, employers must also set up a seamless process of grievances.

Benefits of ERISA Retirement Plan

If you own any ERISA-covered retirement or any other plan, ERISA law will protect against creditors, bankruptcy proceedings, and civil lawsuits. This means if your employer goes bankrupt, your savings and account will not be affected. Your creditors do not have a right to claim via the funds of the retirement.

- Erisa also imposes certain penalties and punishments for any breach from either of the parties. The ERISA-covered retirement plans include terms and conditions for the employees and the employers as well.

- Violations of the ERISA guidelines include withholding benefits, breach of fiduciary duty, stripping off employees of their rights, and more. The participants must follow certain administrative procedures as ERISA regulations are complicated. An alternative is to seek Employee Benefits Security Administration or EBSA assistance.

- Fiduciaries must provide compensation, either through civil penalties or criminal punishments, if they are found guilty. Civil penalties would include a fine and a change in the structure of plans. However, criminal punishment may lead to conviction, inclusive of fines.

Employee Retirement Income Security Act of 1974 for Small Businesses

Small companies often find it hard to abide by the complicated ERISA plans. SIMPLE IRA or “Savings Incentive Match Plans for Employees” was set up for small organizations as an alternative. It is an alternative retirement plan that small-scale companies can deploy. Small organizations are companies with a workforce below 100.

Perks of this ERISA bond are no reporting and administrative burden, which is why they can be set up seamlessly. If an employer selects SIMPLE IRA, the process would require filing IRS forms 5304-SIMPLE or 5305-SIMPLE.

Apart from the norms stated above, employers have to comply with ERISA rules otherwise. Clauses regarding eligible employees, contribution in funds, and other factors remain the same as ERISA. Employers must provide a SPA in any case to the employees.

Laws addressed under ERISA

- The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA)

- The Health Insurance Portability and Accountability Act of 1996 (HIPAA)

These are the two inclusions in the ERISA compliance or law. These two acts specifically address health insurance. COBRA facilitates norms of termination (not misconduct) for separated employees, where they can purchase health coverage for up to 18 months. Purchase of health coverage for spouses and children is allowed up to 36 months. In cases of divorce, previously covered spouses can continue to avail themselves of the benefits.

HIPAA, on the other front, excludes all the barriers of changing employers or health insurance providers. The act excluded the pre-existing conditions addressing employee actions.

FAQs

What is an ERISA plan?

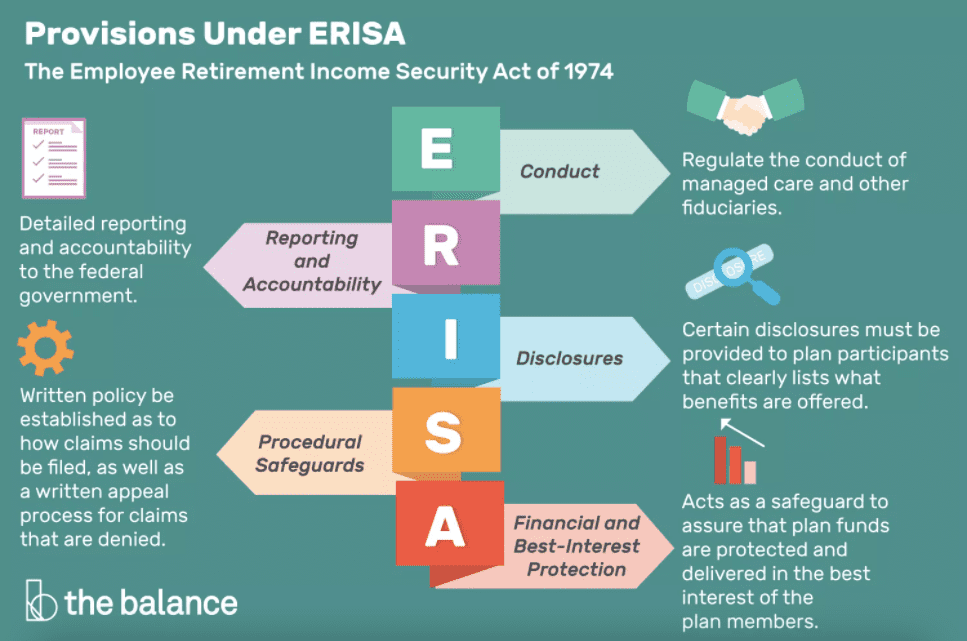

Provisions adhering to the act are conduct, reporting and accountability, disclosures, procedural safeguards, and financial best-interest protection. Private-sector employers need to comply with these norms when offering retirement or other benefit plans to their employees. This law came into force to safeguard the interest of the employees who avail of employer facilitated plans.

ERISA vs. non-ERISA

The executive agency that provides people with retirement income is the provider of information as well. ERISA law does not apply to agencies and government plans, and they are classified as non-ERISA. However, private sector employers who provide retirement plans must comply with the ERISA law.

What are fiduciary responsibilities?

Fiduciaries must keep their benefits aside and work in the interest of the plan’s participants. They must duly draw the features of the plan for their participants and must disclose all the essentials. Fiduciaries must as well ensure appropriate diversification of the plan to minimize losses for the participants. Any fiduciary who does not comply with the responsibilities is charged with a breach. Some examples of fiduciaries are plan trustees, plan administrators, and members of a plan’s investment committee.