If you’ve recently hired your first few employees, chances are you’re Googling things like how many hours are in a work year or what’s full-time, technically? And yeah—those searches matter more than they seem.

Understanding how many working hours are in a year is one of those behind-the-scenes details that sets the foundation for everything: PTO policies, salaries, capacity planning, even burnout prevention. But if you’re a first-time founder without an HR background, it’s easy to feel like you’re guessing.

This guide is for you. We’ll break down exactly how to calculate work hours per year, explain where flexibility makes sense, and offer practical tips that help you stay compliant without getting buried in red tape.

Let’s get into it.

So… How Many Working Hours Are in a Year?

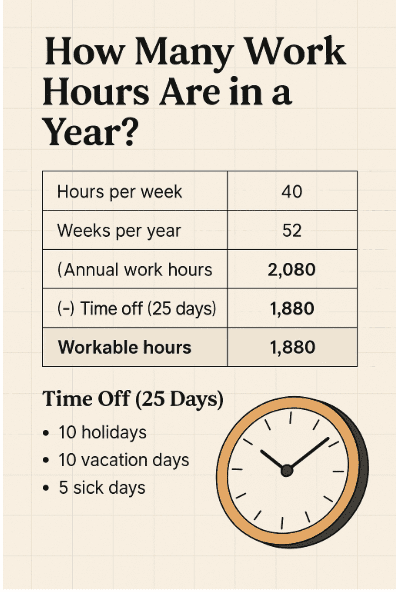

Here’s the short answer: a full-time employee typically works about 2,080 hours in a year.

That’s based on a 40-hour workweek × 52 weeks. Simple math, but here’s what that looks like in practice:

- 40 hours/week × 52 weeks/year = 2,080 hours/year

But real life? It’s rarely that clean. You’ve got holidays, PTO, sick days, and maybe even 4-day workweeks or async schedules—especially at a startup. So while 2,080 hours is the ballpark number most people use, it’s totally fine (and smart) to build in flexibility.

What If You Don’t Use a 40-Hour Week?

If your team works fewer hours or you’re experimenting with something like a 32-hour workweek, you’ll want to recalculate:

- 32 hours/week × 52 weeks = 1,664 hours/year

That’s your new baseline. Knowing this number helps you:

- Pro-rate salaries fairly

- Set expectations around PTO

- Plan capacity without overloading your team

It also makes tracking and planning easier if you’re using tools like AttendanceBot, which can automatically keep tabs on hours worked and time off—no spreadsheet required.

Workable Hours in a Year: The Real-World Version

That 2,080-hour estimate? It assumes zero time off. But your team’s not robots. They’ll take vacations, sick days, and holidays (and they should). So let’s subtract the stuff that actually takes people out of work:

Here’s a rough example based on a typical U.S. setup:

- 10 paid holidays

- 10 vacation days

- 5 sick days

That’s 25 days off total, which means:

- 25 days × 8 hours/day = 200 hours off

- 2,080 total hours – 200 hours = 1,880 workable hours per year

If you’re giving more generous PTO (say, unlimited vacation or mental health days), your working hours in a year might drop even lower—and that’s okay, as long as it’s sustainable for your team and your goals.

Want to get even tighter? You can calculate:

- work hours per year per employee

- adjusted capacity for part-time or flex schedules

- custom PTO policies without losing track

Why Understanding Work Hours is the Key to Avoiding Burnout at Your Startup

As a first-time founder, you’re likely feeling the weight of trying to do everything—from hiring to managing team schedules. One thing you shouldn’t overlook? Understanding the real, workable hours in a year, and how that plays into your team’s productivity and well-being.

The truth is, knowing how many hours your team works in a year isn’t just about setting the right policies. It’s about avoiding burnout and ensuring your startup stays on track without overworking people. Too many founders focus on “How many hours in a year can I get?” instead of thinking, “How can I make the most of the hours my team has?”

Here’s a simple guide to do just that:

- Start by estimating total workable hours (which will always be less than 2,080 thanks to holidays, sick days, and the like).

- Use those hours to set realistic expectations around productivity, project timelines, and even hiring.

- Prioritize well-being and flexibility—because burnout can drain more than just hours; it kills morale and productivity, too.

By measuring actual hours worked and adjusting for flexible schedules, you’ll keep your team happier and more productive in the long run.

How to Use a Work Hours Tracker Without Getting Stuck in the Weeds

As a first-time founder, it’s tempting to keep track of your team’s hours with spreadsheets or paper timesheets. But let’s face it—manual tracking can be a headache. The good news? You don’t have to reinvent the wheel or spend hours on busywork. With the right tools, tracking work hours can be quick, efficient, and even automatic.

Here’s how to set up a work hours tracker that won’t make you want to pull your hair out:

- Pick the Right Tool: You don’t need anything fancy. Tools like AttendanceBot are perfect for startups—they’re easy to set up and integrate seamlessly with platforms like Slack and Microsoft Teams.

- Automate Time Tracking: Let your tool handle the heavy lifting. With automatic time tracking, you won’t have to constantly remind your team to clock in or out. Plus, you’ll save time on manually calculating worked hours and PTO.

- Stay Flexible: The best part about using work hours tracking tools? Flexibility. Whether you have remote employees, part-timers, or full-timers, you can customize tracking for different work schedules.

- Monitor and Improve: As your team grows, your needs will change. Use your tracking tool’s reports to see where your team’s time is going and adjust accordingly. If someone’s consistently working overtime, it’s time to re-evaluate workloads before burnout hits.

- Simplify Payroll: When the time comes to run payroll, you’ll already have all the data neatly compiled. This ensures accurate paychecks and compliance with labor laws—without having to manually tally up hours each pay period.

By using a work hours tracker, you’ll not only streamline your operations, but you’ll also make sure your team stays productive and happy. The easier it is to track time, the easier it is to keep everything running smoothly—without getting bogged down in the details.

The Startup Founder’s Guide to Staying Compliant with Labor Laws (Without Stressing Out)

As you’re building your startup, the last thing you want to worry about is running afoul of labor laws. The good news? You don’t need a legal degree to get it right. But you do need to be aware of the basic requirements—especially around work hours, overtime, and time off.

Here’s what you need to know to stay compliant without the stress:

-

Know the Basics of Work Hours:

- In most places, the standard workweek is 40 hours, but that can vary depending on where your business is located.

- For example, in the U.S., non-exempt employees (those eligible for overtime) are entitled to overtime pay if they work more than 40 hours per week.

- In Canada, similar rules apply, but there are also provincial differences. Always check your local labor laws.

-

Overtime Pay:

- Be aware of what constitutes overtime. In the U.S., employees who work over 40 hours a week are entitled to time-and-a-half for those extra hours.

- Some countries, like the UK, have different overtime rules, often requiring premium pay or time off in lieu. Make sure you know the rules in your country and for any remote team members abroad.

-

Paid Time Off (PTO):

- While PTO isn’t legally required in every country, it’s best practice to offer vacation days and sick leave to avoid burnout and attract talent.

- In the U.S., there’s no federal law requiring paid vacation or sick days, but state laws may differ. In Canada and the UK, paid vacation time is a requirement.

-

Record-Keeping:

- Maintaining accurate records of employee work hours, PTO, and overtime is essential for compliance—especially when tax time rolls around.

- Using tools like AttendanceBot can automatically log hours and track time off, keeping your records clean and ready for audits or payroll processing.

-

Breaks and Meal Time:

- Employees are often entitled to breaks during the workday, depending on the jurisdiction. In the U.S., breaks are required by law for employees working over 6 hours, but meal breaks are typically only required after 5 hours.

- Ensure your team knows when they are entitled to breaks, and have a system for recording them.

-

Hire for Flexibility:

- As a startup, flexibility is key. But even as you adapt to changing work schedules (like offering remote work or flexible hours), make sure you’re still adhering to minimum wage laws, overtime regulations, and any local labor standards.

Quick Tip: Stay ahead of compliance by using digital tools that integrate time-tracking with payroll systems. This way, you’re not only staying compliant but also saving time and avoiding errors.

By staying on top of these basic labor laws, you can avoid costly mistakes and ensure your team’s legal rights are respected. Plus, with tools you can easily track hours, manage time off, and stay compliant—without the legal headaches.