When a candidate joins a new organization, the employer provides them with the IRS W4 form. This is also known as the employee withholding certificate. It is important to fill this form as a part of joining formalities because this determines how much tax the employer would withhold from the employee’s paycheque.

This is a guide that will spell out the answer to the most basic question: how to fill out a w4 for dummies. We’ll discuss the latest W4 form and all the changes therein, how to fill it, and more.

What is a W4 Form?

Also known as ‘Employee’s Withholding Certificate,’ a w4 form is an IRS form which the employees are required to fill at the time of their joining. This enables employers to determine what amount of taxes can be withheld from the employee salaries and helps in calculating payroll taxes. The employers then, basis these calculations, remit the relevant taxes to the IRS or Internal Revenue Service, on the employees’ behalf.

The employees can also claim exemption, in case there was no liability during the relevant period for which the tax has been deducted.

What Changes Does the New W4 Form Bring Along?

Hence, it is important that you inform your employees of the W4 form changes and encourage them to be aware of the right form before declaring the relevant information.

Following are the significant changes:

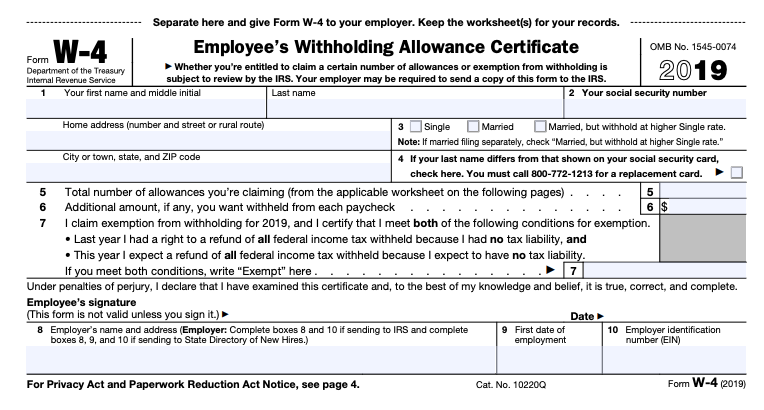

Name of the W4 Form

Earlier, the W4 form was known as the ‘Employee’s Withholding Allowance Certificate.’ This has now changed. This form will now be known just as ‘Employee’s Withholding Certificate.’ The reason being, the form no longer has a section for allowance calculation. That part of the form has been removed, and, the name is changed. While telling your employees to fill in the details, make sure that they download the correct form.

Personal Allowances Worksheet

When the allowance calculation section no longer exists, it is obvious that the personal allowances worksheet would no longer exist as well. This was earlier present on the third page of the old W4 form.

The Exemptions

Another noticeable change is that the TCJA (Tax Cut and Jobs Act) eliminated personal exemptions which were deducted against the personal income of the employee, which in turn reduced their taxable income, and further, the taxes.

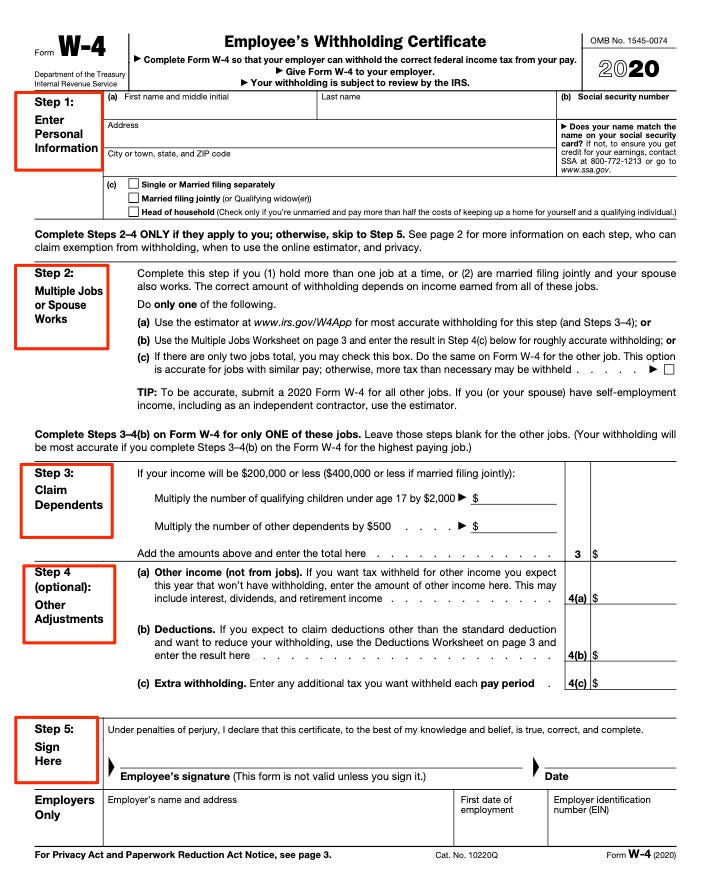

New Worksheets

The new W4 form comes with two new worksheets; multiple jobs worksheet and deductions worksheet. While the former is for employees who are employed in more than one establishment, the latter is to be filled by if they want to itemize their deductions.

Old W4 Form

New W4 Form

How to Fill out the Latest W4 form?

The first step towards getting a W4 form filled is downloading it from the IRS website. It comprises five sections as opposed to the earlier form that had seven sections. The aim of the new form is to simplify the procedure for the employers as they calculate the amount to be withheld.

If your employee is single or is married to a non-working spouse, does not have any dependents, and is not even claiming any deductions apart from the standard one, the form filling procedure is fairly simple. The only details required to fill the form are name, address, social security number, filing status, signature, and date.

Here’s how to fill out this form for an employee. Alternatively, you can ask them to fill the forms using the following steps.

Step 1

The first step is to provide all the basic details, such as name, address, social security number. After these details, the employee can simply sign the form and be done.

Step 2

The next step is determining whether or not the employee has a working spouse or if he or she is working multiple jobs. In that case, the employee can exercise either of the three options:

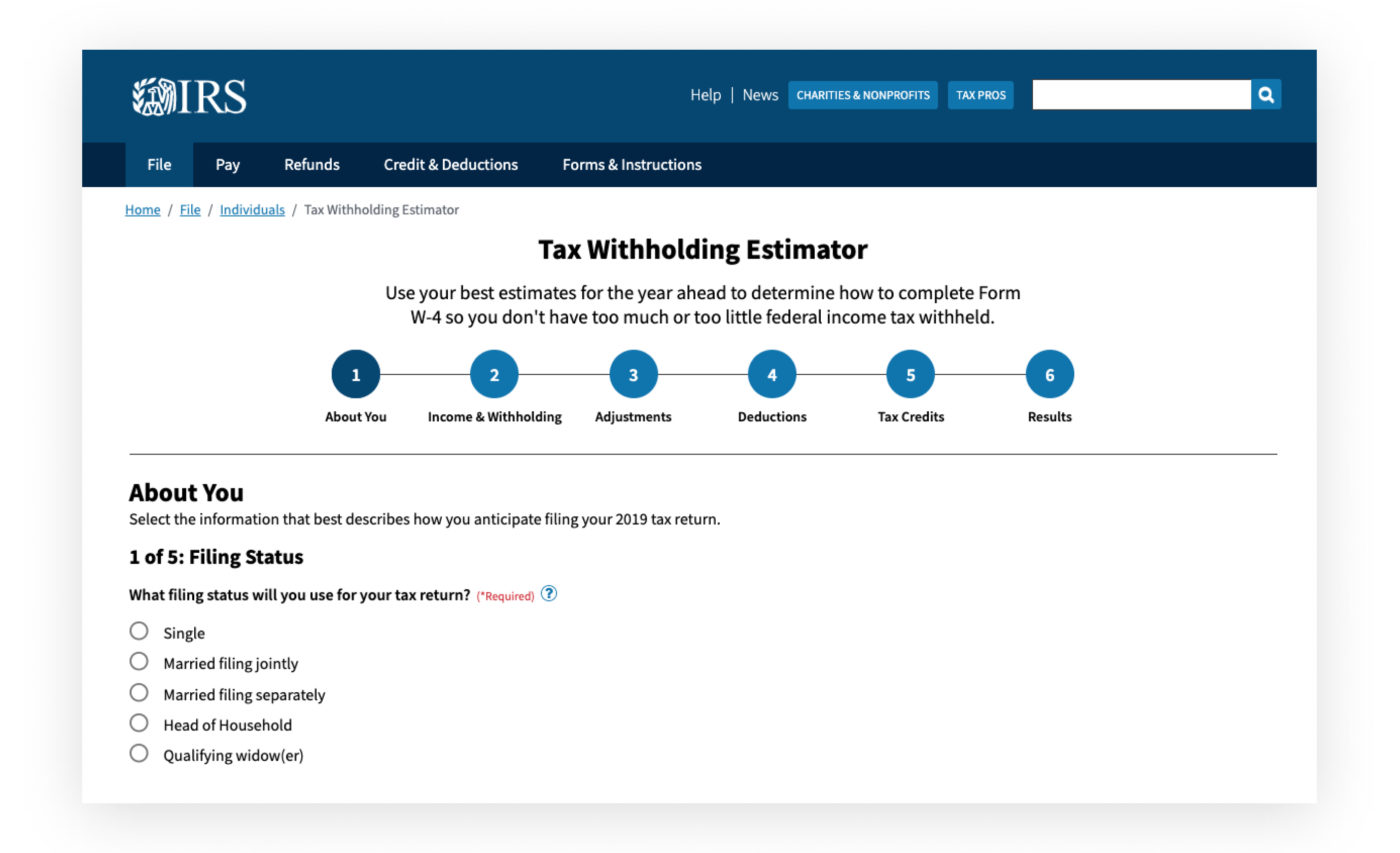

- Using the Tax Withholding Estimator of IRS

- Filling out the multiple-job worksheet. As per IRS, if a person has multiple jobs then they should enter the details of the highest-paying one under section 4c

- If there are two jobs with a similar pay scale, then the employee should enter the result for both in section 4c.

Step 3:

This is applicable in case the employees have any dependents. In that case, they can claim Child Tax Credit and even credit for other dependents. Usually, single employees can claim a credit of up to $200,000, while married taxpayers who are filing a joint return can claim a credit of up to $400,000. A dependent usually refers to a qualifying relative or a qualifying child who lives with the employee and is financially dependent.

Step 4:

The fourth section of the form works on an additional income of the employees, which may exist in the form of interests and dividends. It is important to disclose all income, or else withholding of too little tax by you may lead to penalties and interest, and eventually, even a fat tax bill. To avoid the same, the following subsections of section four need to be filled:

4a: The employee should enter any ‘non-job’ income here.

4b: This section should be filled if the employee wishes to claim other deductions.

4c: If the employee has multiple jobs and wants the additional tax to be withheld, those details should be entered here.

Step 5:

This is the easiest yet the most important step. Ensure that the employee signs the form correctly and enters the right date. An unsigned and undated form is considered invalid, even if all the details are complete and correct. It’s the signature and date that make the form valid and legal. Post this, the form will be filed with the IRS, by the employer.

Please note that if an employee has joined the organization mid-year and was further not employed at any other place during the previous half of the year, it’s considered a tax-saving opportunity. If an employee has worked for less than 245 days in a year, one written application is all that is needed by the employer to calculate the tax withholding using the part-year method.

What to Keep in Mind While Filling the Latest W4 Form?

As an employer, filling out the new w4 form can sound intimidating, but it is not if you keep a few things in mind:

Check the Version

This is the most important step. Ensure that your employees have the latest version installed on their systems. In case the employees are okay with the details on the previous version they can fill that one. However, if they want any changes therein, it is recommended that they fill the W4 form.

No Withholding Allowances

This is one of the major changes brought about in the new W4 form, the elimination of withholding allowances. These were basically exemptions from federal income tax.

Claims

Instead of withholding allowances, now the employees have the option of claiming deductions in the form of dependents.

Layout

The new W4 form comes with an entirely new layout as compared to the previous versions and can basically be filled in five easy steps, as explained earlier in the article.

New Tax Withholding Tables

IRS has now updated its income tax withholding tables in the new WW4 form. There are now two tables; Wage bracket method tables in case the employers have a manual payroll system and Percentage method tables in case of an automated payroll system.

State Changes

Check if your state has a separate W4 form or do they use a federal w4 form. This is important.

While there are chances that no one will become an immediate expert in filling the new W4 form, but there is definitely a scope of learning here. Research and repeat your steps until you get it right.

Filling the New W4 Form: FAQs

Every change brings forth multiple queries. The new W4 form is no exception. Here are a few frequently asked questions and their answers.

W4 form FAQ 1: How Often Should You File the W4?

The experts recommend filling the form at least once a year. However, revisit the form in the event of an employee’s marriage or parenthood (thus earning a dependent). This helps the employer in withholding the exact amount of tax from the paycheque, thus doing away with the possibility of either underpaying or overpaying.

W4 Form FAQ 2: How Many Allowances Can be Claimed?

This is a trick question. The W4 form has done away with the option of claiming allowances. Instead, the process has become simpler which enables the employee to assess the withholding amount basis the financial situation.

W4 Form FAQ 3: How to Decide Whether to Revisit the W4 Form?

Filing the W4 form is an obvious choice. But the confusion lies in whether to revisit it or not. Here are a few questions that will help answer the question:

- Is the employee married?

- Does the employee’s spouse work?

- Has the employee entered parenthood?

- Are there any dependents in the employee’s household (children or otherwise)?

- Did the employee get any large amount of refund in the previous year?

If the answer to any of the above-mentioned questions is “yes,” then you should revisit employee’s w4 form within the year.

W4 Form FAQ 4: What is Tax Withholding Estimator?

IRS, along with the new W4 form has also introduced a method for simplifying the calculations. A tax withholding estimator is a tool that will give you the exact amount that you need to withhold. However, it is only as accurate as the information entered.

Do You Need to file the Latest W4 form?

The W4 form is an essential part of the payroll information, in accordance with the federal income tax withholding rules. This is one of the employment tax responsibilities that are binding on the employers and can entail penalties, in the event of failure. Thus, it is important to withhold taxes on behalf of the organization’s employees.

What are the new things you have learned about the new W4 form at your organization? Do tag us at @HarmonizeHQ and let us know.