The coronavirus has not only taken a toll on people’s health, but it has also affected businesses drastically, especially new and small ones.

Looking at how it is becoming difficult for small businesses to sustain themselves in these crucial times, the U.S. federal government designed the PPP, Paycheck Protection Program loans in 2020, intending to help them.

The loans are quite flexible and helpful for businesses. They help the companies cover multiple costs that help them maintain payroll without furloughs and continue operation without interruptions.

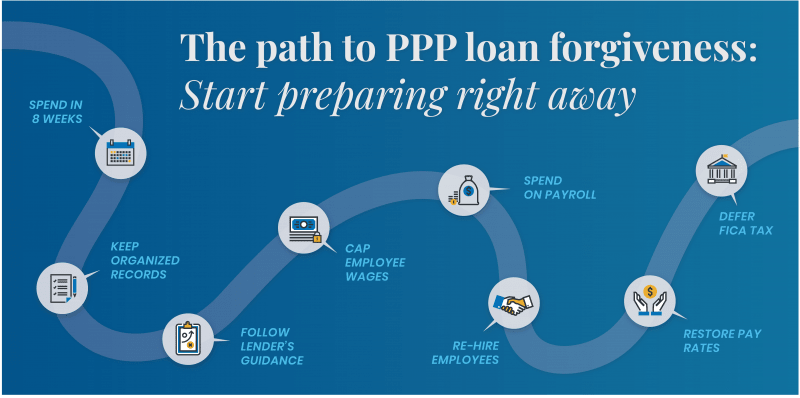

Businesses that take a loan can also apply for a PPP loan forgiveness at any time during or before the loan reaches maturity. For this, there are a few PPP guidelines that the companies should follow.

Here is an article that can help understand the all PPP loan forgiveness guidelines.

How Does a PPP Loan Work?

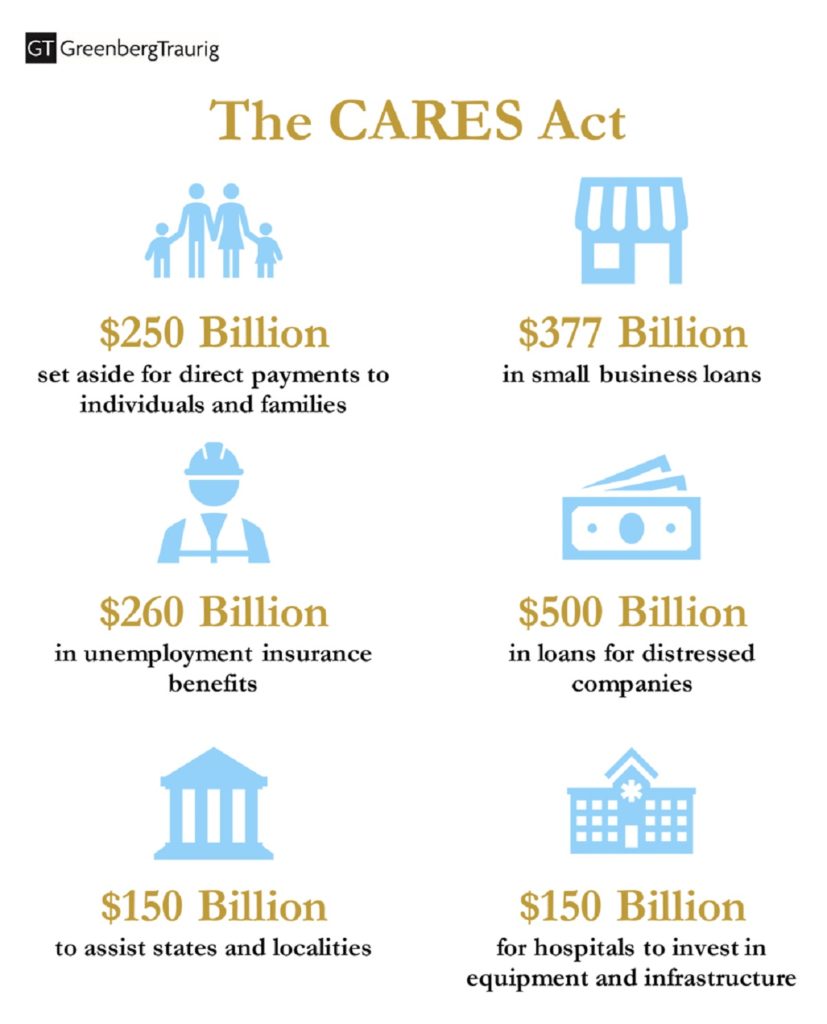

The government carried out the PPP Loan Program under the Coronavirus Aid, Relief, and Economic Security Act( CARES) to help small businesses pay their employees and aid these businesses in coronavirus-related obstacles. PPP loan provides a direct financial life jacket to American businesses.

Donald Trump first introduced these loans in 2020. The funding for the first round was exhausted in August 2020, after which the government went in for a second and third round of funding. These are some of the rules set by the government for eligibility:

- The firm should not have more than 500 employees

- The business should be operational

- If the business runs at multiple locations, each branch should not have more than 500 employees

Once established, the Biden government has modified the PPP rules with many follow-up bills, and they have made provisions for an extended deadline as well.

The Changes Brought To PPP Loans By The Biden Government

- The Biden Government has made provisions to allow self-employed individuals and independent workers more relief under PPP loans

- The new PPP loan terms allow business owners defaulting on student loans to be eligible for a loan

- Non-citizen lawful residents are also eligible for a PPP loan now

- Business owners with non-fraud felonies can get a loan as long as they are not under incarceration at the time of application

Along with these updates, the government has also made a PPP loan forgiveness update to the PPP loan forgiveness scheme. There are a few eligibility criteria and regulations small businesses have to follow for this, after which they can apply for PPP loan forgiveness.

What Is PPP Loan Forgiveness?

Businesses that have borrowed funds through the CARES Act can apply for PPP loan forgiveness once they have used up all the fund they received from the government. Individuals can apply for forgiveness at any time before the time of maturity.

Borrowers can get partial or total PPP loan forgiveness. But how can one determine the amount of PPP forgiveness?

Calculate The Maximum Amount Of PPP Loan Forgiveness

- Determining the expenditures of the borrower during the 24 weeks after they take the loan

- Finding out if there are any reductions in the maximum PPP loan value

- Making sure that 60% of the loan is going towards payroll

As mentioned above, the government has made a PPP loan forgiveness update.

These changes can make the overall approach towards PPP loan forgiveness a little confusing. Let’s discuss the new PPP loan forgiveness guidance comprehensively.

PPP Loan Forgiveness Terms

The first and second rounds of PPP loan forgiveness had their own set of rules. The government set these PPP guidelines for the companies:

- 60% of the loan proceeds should go towards payroll. It includes the salary, vacation leaves, sick leaves, and health benefits for employees.

- The borrower should use the remaining 40% of the PPP loan money for eligible expenses like rent, utilities, and mortgage interest.

- Employee count and compensation levels should be the same.

PPP Loan Forgiveness Requirements

According to PPP loan forgiveness rules, there are quite a few costs eligible for PPP loan forgiveness. But they should meet the following requirements:

Payroll Proportion

The PPP loan forgiveness update that falls under the Paycheck Protection Program Flexibility Act of 2020 allows businesses to have more relaxations in payroll requirements.

Earlier, the businesses had to use at least 75% of their loan money on payroll, and they could use the rest on rent, utilities, and mortgage. But now, they can use 60% on payroll and 40% on other eligible costs.

The government has also made provisions under which small businesses can use less than 60% on the payroll. But the borrowers will have to face reductions in the PPP loan forgiveness. For example, if the company has only used 50% of the PPP loan on payroll, they can get 50% PPP loan forgiveness on the total amount.

Business owners can also calculate the maximum forgiveness amount if they want. All they have to do is divide the total payroll expenditures by 0.6.

Maintaining Employee Headcounts

According to the PPP loan forgiveness update, if a business owner takes a loan of over $50,000, they need to maintain the employee headcount at the time of the loan application.

It is because the reason why the government launched the PPP loan was to help sustain jobs. If businesses cannot sustain headcount, the entire purpose of the PPP loans is lost.

But how would borrowers know if they have met this requirement? They need to calculate the full-time employees(FTE) for this.

How To Calculate The FTE For PPP Loan Forgiveness?

To calculate the FTE, borrowers can use the following steps:

- Every employee who works 40 or more hours in a company counts as one employee.

- The borrower then needs to find the average working hours per week for the employees who work less than 40 hours a week.

- After this, the borrower should divide the hours they found out by 40 and round the result to the nearest tenth. For example, if an employee works 20 hours a week, the borrower will divide it by 40, and the answer will be 0.5 FTE.

- Full-time employees of the company(who work 40 hours a week) will have the maximum FTE at 1.0 FTE.

The SBA can then use this data to reduce the PPP loan forgiveness. They can use the following periods to do that:

- February 15, 2019, to June 30, 2019

- January 1, 2020, to February 29, 2020

It will give the loan forgiveness reduction percentage. One can find out the loan forgiveness reduction by multiplying the same by the loan forgiveness amount.

PPP Loan Payment Requirements

The PPP loan forgiveness update requires a company to maintain at least 75% of an employee’s salary during the loan period.

The requirement applies to every employee who got less than $100,000 at an annualized rate in 2019 or 2020, whichever year the borrower uses to calculate the PPP loan.

If an employee’s pay is less than 75%, the PPP loan forgiveness will also reduce. The PPP loan will face a reduction that will be equal to the difference between the employee’s current pay and 75% of their original pay.

PPP Covered Period

The PPP forgiveness rules allow coverage of any expenses that the company has in at least eight weeks or no more than 24 weeks. It is also called the covered period.

The period starts from the time the borrower gets the loan money. But it is not necessarily the day they sign the loan documents. The business owners can choose the period that suits them the best as long it is not less than eight weeks and more than 24 weeks.

The eight weeks PPP covered period has its benefits. When a business owner applies for a PPP loan forgiveness, they can do so without worrying too much about FTE(full-time equivalency). They can make the decision based on what is more beneficial with regards to the current economic situation.

The 24 weeks PPP covered period is good for the businesses that want to capture the payroll costs experienced and paid. It helps because the company may not cover these costs in the short period of eight weeks.

What Happens If A Company Cannot Meet The PPP Loan Forgiveness Requirements?

There can be cases where the business owners may see declining FTEs in the PPP covered period. If that happens, there are two ‘safe harbors,’ and one exemption that can help avoid a reduction in the PPP loan forgiveness. There is a safe harbor for wage reduction as well.

FTE Reduction Safe Harbor 1

Business owners can use a safe harbor if they document that their business was fully or partially shut. The period of inability to operate should be between February 15 and the end of the PPP covered period.

The inability to operate has to be under non-compliance of the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration rules from March 1 and December 31.

These rules are related to social distancing, sanitization, and other safety rules that any business has to follow because of Covid-19. T

FTE Reduction Safe Harbor 2

The second safe harbor allows two relaxations for companies that could not restore FTE as fast as they expected. It could be for the following reasons:

- The owner reduced the FTE count between February 15, 2020, and April 26, 2020.

- The borrower restored the FTE count not later than December 31, 2020, to the FTE levels in their pay period, including February 15, 2020. There is an extension in the deadline to the end of the eight weeks or 24 weeks covered period for loans taken after December 27, 2020.

The borrower can meet this safe harbor rule by restoring the FTE to the one on February 15, 2020 by the end of the covered period.

FTE Reduction Exceptions

Other PPP rules can also help avoid reductions in the PPP loan forgiveness. These are called FTE Reduction Exceptions, and they apply to employers who meet the requirements.

The situations that qualify for FTE Reduction Exceptions are:

- The borrower has made a written, good-faith offer to rehire an employee who was an employee on February 15, 2020, for a position. They can only do this on the condition that they could not hire a similarly qualified individual for the job before or on December 31, 2020.

- The borrower has made a written, good-faith offer to restore the reduction in hours at the same salary during the PPP covered period, but the employee rejected the offer.

- The company has to fire an employee for cause, voluntarily resign, or voluntarily request or receive a reduction in hours.

To support any of the above, the borrower needs to have evidence with them. It includes any documents supporting the firing of an employee or reducing their hours. The same rule applies for rehiring and rejections.

Salary/ Hourly Wage Reduction Safe Harbor

If a borrower reduces the salary of an employee who earns less than $100,000 annually by more than 25% during the PPP covered period, they have to face a reduction in PPP loan forgiveness. But there is a safe harbor that can prevent this reduction as well. Here are the criteria for eligibility for it:

- The borrower is eligible for the safe harbor if an employee’s annual salary between February 15, 2020, and April 26, 2020, is more than or equal to their annual salary as of February 15, 2020.

- An employee’s average annual salary as of February 15, 2020, is more than or matches the average yearly wage of December 31, 2020.

PPP Loan Forgiveness Application

There are different PPP loan forgiveness applications. Let’s see all the different types and the use cases.

3508S Form

The Economic Aid Act provides the 3508s application form for borrowers with $150,000 worth of loans, raised from $50,000 or less. The application form also applies to businesses that affiliated with other companies and the total loan of all these affiliates is more than $2 million.

The PPP loan forgiveness update now provides a new check box to indicate whether the borrower had borrowed in the First Draw or Second Draw. Another change is the removal of the boxes for the EIDL application number and advance amount.

The borrower then needs to prove that the company has used the loan for PPP loan forgiveness eligible costs like payroll, utility, and rent. They also need to provide documents that show that they used 60% of the loan for payroll.

3508EZ Form

Borrowers who can apply for the 3508EZ form are the following:

- Self-employed individuals or the ones who do not have any employees under them.

- Borrowers did not reduce the employees’ annual salary by more than 25% in the PPP covered period.

- The borrowers who did not reduce the number of employees between January 1, 2020, and the end of the PPP covered period.

- Borrowers could not run their business to the same capacity because of non-compliance with the Health Administration’s sanitization rules.

Regular 3508 Form

If a borrower does not qualify for the 3508S and 3508EZ forms, they should opt for the 3508 form.

Any business owner who receives a PPP loan can fill up this form application. But it is the most complex one and is better to use only if the other two get rejected.

The application form contains five pages. They are as follows:

- Schedule A

- Schedule A Worksheet

- Calculation Form

- Signature/Authorization form

- An Optional Demographic Information Form

The application is more complex because it contains calculations regarding reduction in salaries or employee count. If an owner reduces either of these, they have to face a reduction in the PPP loan.

The application helps borrowers calculate the amount of money that will get reduced from the PPP loan forgiveness.

How To Apply For PPP Loan Forgiveness?

After going through all the above-mentioned PPP loan forgiveness requirements, borrowers can fill one of the applications for PPP loan forgiveness.

When To Apply For PPP Loan Forgiveness?

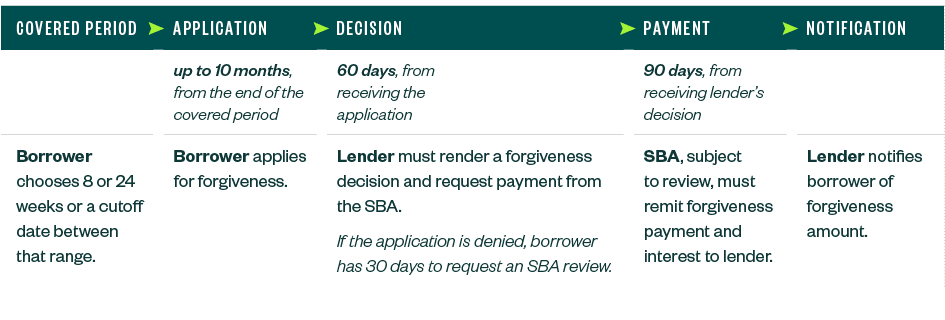

Borrowers can apply for PPP loan forgiveness anytime before the completion of the maturity of the loan. But the borrower has to apply for PPP forgiveness within ten months after the last date of the covered period.

If the borrower does not do so, they cannot defer the loan, and they have to start paying it. When the loan money hits the bank, the borrower does not have to worry about payment for about a year. If the borrower considers that, it is better to apply for forgiveness before making the first payment.

How To Apply for PPP Loan Forgiveness?

Talk To Your Lender

The first step to get PPP loan forgiveness is contacting your lender. They will provide the application form for forgiveness. The applications they could give the borrower are 3508, SBA Form 3508EZ, SBA Form 3508S, or lender’s equivalent.

Set Aside All Required Documents

The borrower has to provide some universal documents:

- Photo ID

- Bank statements

- SBA loan number

Apart from these documents, there are some other documents that the borrower has to provide. These documents are as follows:

Owner Compensation Replacement

If the borrower is self-employed, they need to show bank statements to prove that they have drawn their owner compensation replacement. They need to show their federal tax documentation as well to show their past compensation.

Payroll Costs

For these costs, the borrower has to provide documents from their payroll provider. They need to provide tax forms for the period overlapping the covered period and payment receipts as well.

Non-Payroll Costs

- Rent payment: The borrower needs to provide the rent or lease agreement and monthly payment proof.

- Mortgage interest payment: The borrower needs to show either an amortization table or mortgage account statements to verify this payment. They may also provide bank statements or payment receipts for the same.

- Utility payment: Utility costs cover electricity, sewage, gas, internet, and telephone. To prove this payment, the borrower needs to show monthly utility statements or receipts.

- Property damage: Borrowers can use a PPP loan to cover damage expenses. The borrower needs to provide cancelled checks, receipts, copies of invoices, or any other document they may have.

- Supplier costs: Borrowers can use the PPP money to cover supply costs. For this eligibility, the supplies must be essential to the working of the business. The purchased item should be in effect before or at any time during the PPP covered period.

- Worker Protection: If a borrower needed to buy sanitization equipment following the Covid-19 rules, PPP covers these costs. These purchases need to comply with the regulations of the Department of Health and Human Services. The supplies include health screening, air pressure ventilation, and other sanitization supplies. For eligibility, the borrower needs to provide receipts or bank statements.

Submission Of Documents

After filling up the application form, the borrower has to submit it along with all the documents. The borrower should also consider consulting the lender for further assistance.

After submission, there has to be clear communication between the lender and the borrower. The lender needs to notify the borrower if SBA agreed to pay their entire loan or not. If not, the lender needs to inform the borrower when they need to start paying.

The government has launched the PPP loan forgiveness program to help small businesses. But the program has undergone many changes, and it may be a bit confusing for business owners to understand how PPP loan forgiveness works.

It becomes essential to research properly, talk to the lender and fill the PPP loan forgiveness application that works best for your business. Things become simple from there.

You can reach out to us at @HarmonizeHQ if you need any help regarding your PPP loan.